Why You Need to Know About LLP company registration in Hyderabad?

Wiki Article

Comprehensive Limited Liability Partnership Formation Solutions in Hyderabad for Startups

Starting a business is a key step for any entrepreneur, and selecting the right business structure can make all the difference in terms of operational freedom, taxation, and risk management. For many emerging ventures and small to medium enterprises, LLP registration in Hyderabad has proven to be an ideal choice. The Limited Liability Partnership structure combines the benefits of both traditional partnerships and corporate entities, providing financial security to partners while maintaining operational simplicity.

Hyderabad, with its rapidly growing business scene and supportive business environment, has emerged as one of the most preferred cities for entrepreneurs to set up their ventures. Whether you are a professional service provider, enterprise, or emerging entrepreneur, opting for LLP formation in Hyderabad ensures a hassle-free combination of compliance, business freedom, and trustworthiness throughout your business journey.

What is LLP and Why It’s Beneficial

A Limited Liability Partnership (LLP) is a modern business form that combines the advantages of a partnership and a corporate entity. In an LLP, each partner’s liability is confined to the extent of their capital contribution, thereby protecting their personal assets from business debts. This makes it a more secure and structured framework for professionals and entrepreneurs seeking reduced risks and transparent governance.

One of the key benefits of LLP setup in Hyderabad is that it provides a recognised structure approved by the Ministry of Corporate Affairs (MCA), making your business legally compliant. It also enhances credibility with clients, stakeholders, and financial institutions. Additionally, LLPs benefit from fewer compliance requirements compared to private limited companies, making them ideal for small and medium-sized businesses aiming for efficiency and affordability.

Why Choose LLP Over Traditional Partnerships or Private Limited Companies

When compared with traditional partnerships, an LLP offers a distinct advantage in terms of liability protection and regulatory structure. In a traditional partnership, all partners share complete responsibility, meaning personal assets could be at risk if the business incurs losses. However, under an LLP, each partner’s responsibility is restricted to their contribution.

Compared to a Pvt. Ltd. entity, an LLP involves fewer compliance requirements such as annual meetings and statutory audits (unless turnover exceeds the limit). It balances flexibility and structure, making it suitable for professionals such as consultants, architects, and small enterprises that seek simplicity without sacrificing legal recognition.

The profit-sharing flexibility, simple ownership structure, and easy dissolution process make LLC registration in Hyderabad a preferred choice for entrepreneurs planning long-term growth.

Key Steps Involved in LLP Registration

Registering an LLP involves a few structured steps governed by the Ministry of Corporate Affairs. Here’s a breakdown of the essential process followed during LLP registration services in Hyderabad:

First, partners must obtain Digital Signature Certificates (DSC) and Director Identification Numbers (DIN), which are mandatory for all designated partners. The next step is reserving a unique business name in line with MCA guidelines. Once approved, partners must prepare and submit incorporation documents, including the LLP agreement, with the Registrar of Companies (ROC).

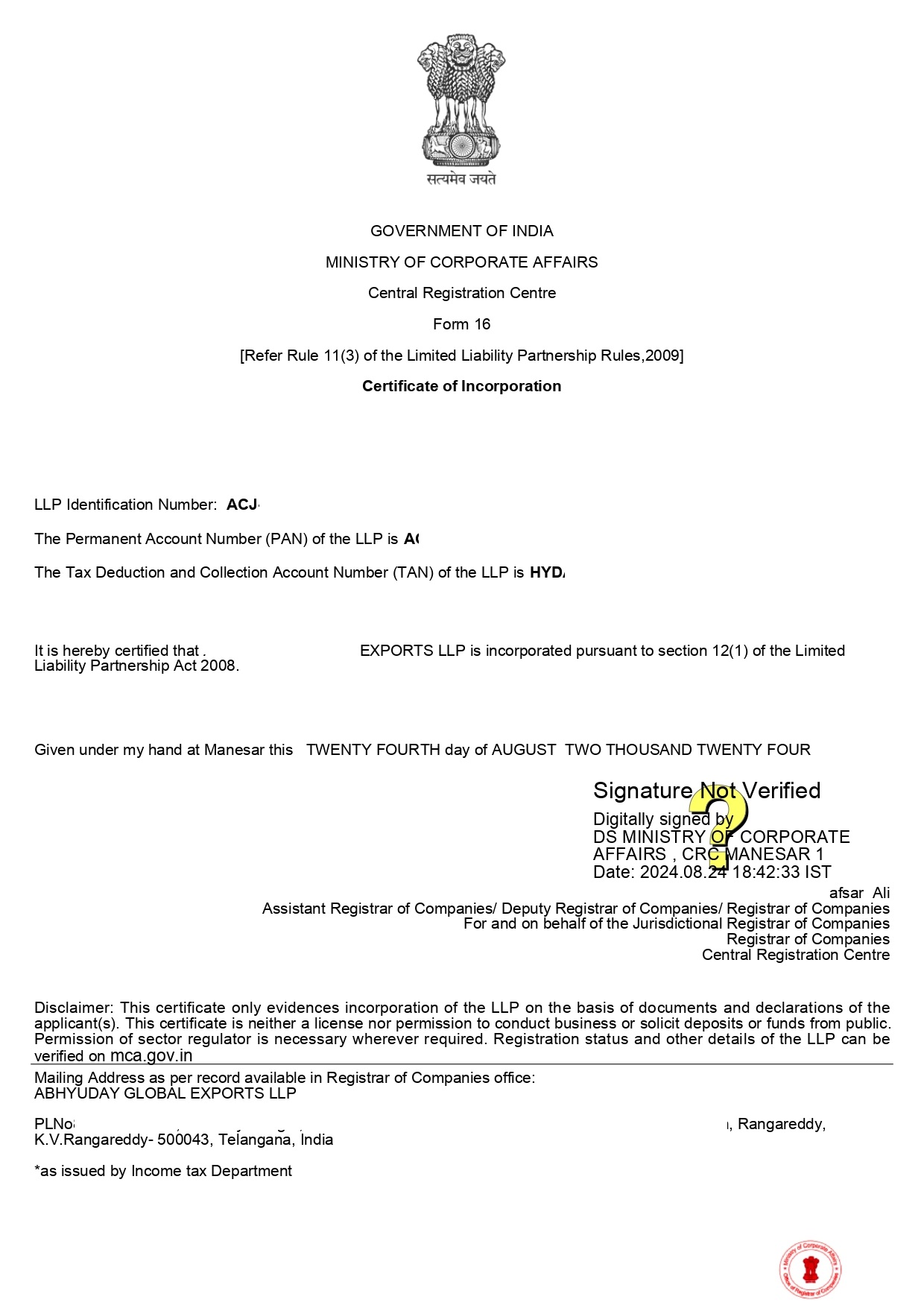

After submission and verification, the official registration certificate is issued, formally acknowledging your firm as a registered LLP. This certificate acts as proof of legal existence and enables the business to open a bank account, apply for PAN, and commence operations under a lawful framework.

Essential Documents Required for LLP Formation

To ensure a error-free LLP setup process in Hyderabad, certain documents are required for each partner and the registered office. These include identification proofs such as PAN card, address proofs like Aadhaar, and latest photos. Additionally, proof of the registered office address (such as a electricity or water bill or rental agreement) and a No Objection Certificate from the property owner are required.

The LLP agreement, defining roles, responsibilities, and profit-sharing ratios among partners, must also be prepared and filed within the prescribed timeline post-incorporation. These documents ensure clarity and provide security to all involved partners.

Advantages of LLP Formation in Hyderabad

The advantages of setting up an LLP in Hyderabad go beyond mere compliance. Hyderabad’s status as a business hub offers robust facilities, a skilled workforce, and strong government support for startups. Entrepreneurs can benefit from easy access to professional LLP incorporation consultants in Hyderabad that streamline the entire process.

LLP formation provides benefits such as separate legal identity, continuous existence, limited liability protection, and flexible structure. It enables entrepreneurs to operate confidently, attract investors, and form partnerships while maintaining legal clarity.

Furthermore, the taxation framework for LLPs is advantageous compared to private limited companies, as there is no dividend distribution tax and minimal administrative burden. For startups, this structure helps save money while maintaining professional reputation with clients and stakeholders.

Expert LLP Consultants in Hyderabad

While the process may appear straightforward, many entrepreneurs prefer expert support to avoid delays or compliance issues. Experienced consultants specialising in LLP company formation services in Hyderabad guide clients through every stage—from name reservation and submission to final incorporation. Their expertise ensures error-free filing and saves time.

These professionals also offer ongoing assistance such as drafting LLP Limited liability partnership registration in Hyderabad agreements, GST registration, bookkeeping, and compliance filings. Such comprehensive services make them trusted allies for startups and established businesses alike.

Post-Registration Compliance and Responsibilities

Once an LLP is registered, maintaining compliance is essential for continued success. Annual filings, including the Statement of Accounts and Solvency and Form 11, must be submitted to the Registrar. Keeping accurate books, maintaining statutory registers, and DSC renewals periodically are also important.

Failure to comply can attract fines. Hence, many business owners rely on professional compliance service providers to handle these tasks efficiently, ensuring that their LLP remains legally sound throughout its business lifecycle.

Wrapping Up

Establishing an LLP provides entrepreneurs in Hyderabad with a strong framework that combines freedom, risk protection, and operational efficiency. By opting for professional LLP registration services in Hyderabad, businesses can ensure a streamlined and compliant registration process while focusing on their core activities. The LLP structure offers legal protection, credibility, and sustainable growth, making it a strategic choice for startups, professionals, and enterprises. With the right guidance and compliance management, an LLP in Hyderabad can serve as a solid foundation for long-term business success. Report this wiki page